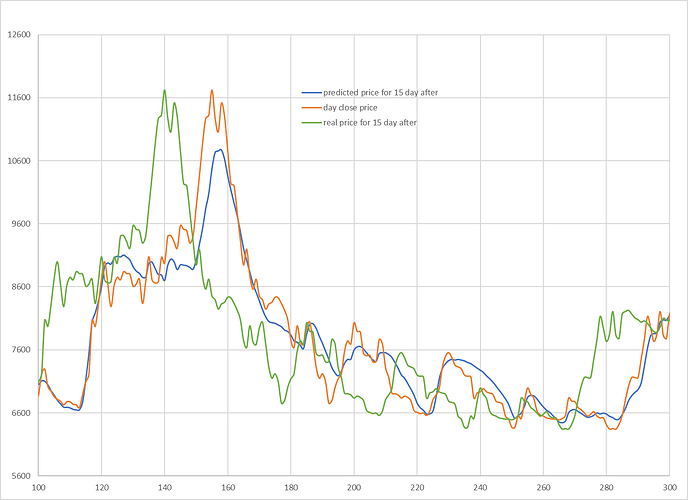

I have written a code in Python with tensorflow and Keras to predict stock prices. In this code, the opening, minimum, maximum and the close price of the day are given as input to the LSTM neural network. In this project, to predict the price of 5 days after in the training and testing stage, I have defined close price of 5 days later as the output. After the training stage, in test stage, I noticed that the outputs are close to the close price of the same day instead of being close to the defined output (the close price of 5 days later). This issue is the same in predicting the price of 10 days and 15 days later. I show the code below, does anyone know where the code is wrong?

from genericpath import isfile

from pickle import FALSE

import tensorflow as tf

from keras.models import Sequential

from keras.layers import LSTM, Dense, Dropout, Bidirectional

from keras.callbacks import ModelCheckpoint, TensorBoard

from sklearn import preprocessing

from sklearn.model_selection import train_test_split

from collections import deque

#import matplotlib.pyplot as plt

import os

import time

import numpy as np

import pandas as pd

import random

import openpyxl as Excel

from tkinter import filedialog as fd

# set seed, so we can get the same results after rerunning several times

np.random.seed(314)

tf.random.set_seed(314)

random.seed(314)

def shuffle_in_unison(a, b):

# shuffle two arrays in the same way

state = np.random.get_state()

np.random.shuffle(a)

np.random.set_state(state)

np.random.shuffle(b)

def load_data(n_steps=50, scale=True, shuffle=True, lookup_step=1, split_by_date=True,

test_size=0.2, feature_columns=['adjclose', 'volume', 'open', 'high', 'low','range','individual_buy_ratio',"individual_sell_ratio",'individual_buy_strange']):

if os.path.isfile(ticker_tradeH_filename):

trade=pd.read_csv(ticker_tradeH_filename)

trade.index=trade["Unnamed: 0"]

del trade["Unnamed: 0"]

else:

raise TypeError("ticker can be either a str or a `pd.DataFrame` instances")

if os.path.isfile(ticker_clientH_filename):

client=pd.read_csv(ticker_clientH_filename)

client.index=client["Unnamed: 0"]

del client["Unnamed: 0"]

else:

raise TypeError("ticker can be either a str or a `pd.DataFrame` instances")

df = pd.concat([trade, client], axis=1,join="inner")

#creat new items

Rcol=[]

Rcol=(df["adjclose"]-df["yesterday"])/df["adjclose"]*100

Rcol[0]=0

df["range"]=Rcol

df["individual_buy_ratio"] = df["individual_buy_vol"]/df["individual_buy_count"]

df["individual_buy_ratio"] = df["individual_buy_ratio"].replace([np.nan, -np.inf,np.Inf], 0)

df["individual_sell_ratio"] = df["individual_sell_vol"]/df["individual_sell_count"]

df["individual_sell_ratio"] = df["individual_sell_ratio"].replace([np.nan, -np.inf,np.Inf], 0)

df["individual_buy_strange"] = df["individual_buy_ratio"]/df["individual_sell_ratio"]

df["individual_buy_strange"] = df["individual_buy_strange"].replace([np.nan, -np.inf,np.Inf], 0)

for col in df.columns:

if col not in feature_columns:

del df[col]

# this will contain all the elements we want to return from this function

result = {}

# we will also return the original dataframe itself

result['df'] = df.copy()

# make sure that the passed feature_columns exist in the dataframe

for col in feature_columns:

assert col in df.columns, f"'{col}' does not exist in the dataframe."

# add date as a column

if "date" not in df.columns:

df["date"] = df.index

if scale:

column_scaler = {}

# scale the data (prices) from 0 to 1

for column in feature_columns:

scaler = preprocessing.MinMaxScaler()

df[column] = scaler.fit_transform(np.expand_dims(df[column].values, axis=1))

column_scaler[column] = scaler

# add the MinMaxScaler instances to the result returned

result["column_scaler"] = column_scaler

# add the target column (label) by shifting by `lookup_step`

future=df['adjclose'].shift(-lookup_step)

df['future'] = future

# last `lookup_step` columns contains NaN in future column

# get them before droping NaNs

last_sequence = np.array(df[feature_columns].tail(lookup_step))

# drop NaNs

df.dropna(inplace=True)

sequence_data = []

sequences = deque(maxlen=n_steps)

for entry, target in zip(df[feature_columns + ["date"]].values, df['future'].values):

sequences.append(entry)

if len(sequences) == n_steps:

sequence_data.append([np.array(sequences), target])

# get the last sequence by appending the last `n_step` sequence with `lookup_step` sequence

# for instance, if n_steps=50 and lookup_step=10, last_sequence should be of 60 (that is 50+10) length

# this last_sequence will be used to predict future stock prices that are not available in the dataset

last_sequence = list([s[:len(feature_columns)] for s in sequences]) + list(last_sequence)

last_sequence = np.array(last_sequence).astype(np.float32)

'''

#################################################

print("first sequence first date",sequence_data[0][0][0][-1])

print("first sequence last date",sequence_data[0][0][-1][-1])

print("last sequence fist date",sequence_data[-1][0][0][-1])

print("last sequence last date",sequence_data[-1][0][-1][-1])

#################################################

'''

# add to result

result['last_sequence'] = last_sequence

# construct the X's and Y's

X, Y = [], []

for seq, target in sequence_data:

X.append(seq)

Y.append(target)

# convert to numpy arrays

X = np.array(X)

Y = np.array(Y)

'''

#################################################

print("first sequence first date",X[0][0][-1])

print("first sequence last date",X[0][-1][-1])

print("last sequence fist date",X[-1][0][-1])

print("last sequence last date",X[-1][-1][-1])

#################################################

'''

if split_by_date:

# split the dataset into training & testing sets by date (not randomly splitting)

train_samples = int((1 - test_size) * len(X))

result["X_train"] = X[:train_samples]

result["Y_train"] = Y[:train_samples]

result["X_test"] = X[train_samples:]

result["Y_test"] = Y[train_samples:]

if shuffle:

# shuffle the datasets for training (if shuffle parameter is set)

shuffle_in_unison(result["X_train"], result["Y_train"])

shuffle_in_unison(result["X_test"], result["Y_test"])

else:

# split the dataset randomly

result["X_train"], result["X_test"], result["Y_train"], result["Y_test"] = train_test_split(X, Y,

test_size=test_size, shuffle=shuffle)

'''

#################################################

print("train first sequence first date",result["X_train"][0][0][-1])

print("train first sequence last date",result["X_train"][0][-1][-1])

print("train last sequence fist date",result["X_train"][-1][0][-1])

print("train last sequence last date",result["X_train"][-1][-1][-1])

print("test first sequence first date",result["X_test"][0][0][-1])

print("test first sequence last date",result["X_test"][0][-1][-1])

print("test last sequence fist date",result["X_test"][-1][0][-1])

print("test last sequence last date",result["X_test"][-1][-1][-1])

#################################################

'''

# get the list of test set dates

dates = result["X_test"][:, -1, -1]

'''

#################################################

print("test first date",dates[0])

print("test last date",dates[-1])

#################################################

'''

# retrieve test features from the original dataframe

result["test_df"] = result["df"].loc[dates]

# remove duplicated dates in the testing dataframe

result["test_df"] = result["test_df"][~result["test_df"].index.duplicated(keep='first')]

xx=pd.DataFrame(result["X_test"][:,-1,:])

xx.index=dates

yy=pd.DataFrame()

yy["results"]=result["Y_test"]

yy.index=dates

testdata = pd.concat([xx, yy], axis=1,join="inner")

testdata.to_csv(test_data_filename)

# remove dates from the training/testing sets & convert to float32

result["X_train"] = result["X_train"][:, :, :len(feature_columns)].astype(np.float32)

result["X_test"] = result["X_test"][:, :, :len(feature_columns)].astype(np.float32)

return result

def create_model(sequence_length, n_features, units=256, cell=LSTM, n_layers=2, dropout=0.3,

loss="mean_absolute_error", optimizer="rmsprop", bidirectional=False):

model = Sequential()

for i in range(n_layers):

if i == 0:

# first layer

if bidirectional:

model.add(Bidirectional(cell(units, return_sequences=True), batch_input_shape=(None, sequence_length, n_features)))

else:

model.add(cell(units, return_sequences=True, batch_input_shape=(None, sequence_length, n_features)))

elif i == n_layers - 1:

# last layer

if bidirectional:

model.add(Bidirectional(cell(units, return_sequences=False)))

else:

model.add(cell(units, return_sequences=False))

else:

# hidden layers

if bidirectional:

model.add(Bidirectional(cell(units, return_sequences=True)))

else:

model.add(cell(units, return_sequences=True))

# add dropout after each layer

model.add(Dropout(dropout))

model.add(Dense(1, activation="linear"))

model.compile(loss=loss, metrics=["mean_absolute_error"], optimizer=optimizer)

return model

def plot_graph(test_df):

"""

This function plots true close price along with predicted close price

with blue and red colors respectively

plt.plot(test_df[f'true_adjclose_{LOOKUP_STEP}'], c='b')

plt.plot(test_df[f'adjclose_{LOOKUP_STEP}'], c='r')

plt.xlabel("Days")

plt.ylabel("Price")

plt.legend(["Actual Price", "Predicted Price"])

plt.show()

"""

def get_test_prediction(model, data):

X_test = data["X_test"]

Y_test = data["Y_test"]

# perform prediction and get prices

Y_pred = model.predict(X_test)

if SCALE:

Y_test = np.squeeze(data["column_scaler"]["adjclose"].inverse_transform(np.expand_dims(Y_test, axis=0)))

Y_pred = np.squeeze(data["column_scaler"]["adjclose"].inverse_transform(Y_pred))

else:

Y_pred=np.squeeze(Y_pred, axis=1)

test_df = data["test_df"]

precloseprice=test_df["adjclose"]

# add predicted future prices to the dataframe

test_df[f"adjclose_{LOOKUP_STEP}"] = Y_pred

# add true future prices to the dataframe

test_df[f"true_adjclose_{LOOKUP_STEP}"] = Y_test

#calculate prediction mistake

predict_prufit=100*(Y_pred-precloseprice)/precloseprice

test_df["predict_prufit"] = predict_prufit

real_prufit=100*(Y_test-precloseprice)/precloseprice

test_df["real_prufit"] = real_prufit

predict_mistake=real_prufit-predict_prufit

test_df["predict_mistake"] = predict_mistake

relative_mistake=predict_mistake/abs(real_prufit)

relative_mistake=relative_mistake.replace([np.nan, -np.inf,np.Inf], 0)

test_df["relative_mistake"] = relative_mistake

# sort the dataframe by date

test_df.sort_index(inplace=True)

return test_df

def predict(model, data):

# retrieve the last sequence from data

last_sequence = data["last_sequence"][-N_STEPS:]

# expand dimension

last_sequence = np.expand_dims(last_sequence, axis=0)

# get the prediction (scaled from 0 to 1)

prediction = model.predict(last_sequence)

# get the price (by inverting the scaling)

if SCALE:

predicted_price = data["column_scaler"]["adjclose"].inverse_transform(prediction)[0][0]

else:

predicted_price = prediction[0][0]

return predicted_price

#### initialize the model hyperparameters

# Window size or the sequence length

N_STEPS = 24 #1 month

# Lookup step, 1 is the next day

LOOKUP_STEP = 15

# whether to scale feature columns & output price as well

##############

SCALE = True

scale_str = f"sc-{int(SCALE)}"

# whether to shuffle the dataset

#############

SHUFFLE = False

shuffle_str = f"sh-{int(SHUFFLE)}"

# whether to split the training/testing set by date

SPLIT_BY_DATE = True

###################

split_by_date_str = f"sbd-{int(SPLIT_BY_DATE)}"

# test ratio size, 0.2 is 20%

TEST_SIZE = 0.2

# features to use

FEATURE_COLUMNS = ["adjclose", "volume", "open", "high", "low","range","individual_buy_ratio","individual_sell_ratio","individual_buy_strange"]

# date now

date_now = time.strftime("%Y-%m-%d")

time_now = time.strftime("%H-%M")

### model parameters

N_LAYERS = 2

# LSTM cell

CELL = LSTM

# 256 LSTM neurons

UNITS = 256

# 40% dropout

DROPOUT = 0.2

# whether to use bidirectional RNNs

BIDIRECTIONAL = False

### training parameters

# mean absolute error loss

# LOSS = "mae"

# huber loss

LOSS = "huber_loss"

OPTIMIZER = "adam"

BATCH_SIZE = 64

EPOCHS = 10

filename=fd.askopenfilename()

name= os.path.splitext(os.path.basename(filename))[0]

cpath= os.path.dirname(filename)

tickerlistwb = Excel.load_workbook(filename)

tickerlistws = tickerlistwb['tickers']

# train result file

if not os.path.isdir(cpath + "\\Train-history"):

os.mkdir(cpath + "\\Train-history")

train_result_filename = cpath + f"\\Train-history\\Train-{shuffle_str}-{scale_str}-{split_by_date_str}-epoch{EPOCHS}-dropout{DROPOUT}-{LOSS}-{OPTIMIZER}-{CELL.__name__}-layers-{N_LAYERS}-seq-{N_STEPS}-step-{LOOKUP_STEP}-units-{UNITS}.csv"

column_name=["loss","Mean Absolute Error",f"Future price after {LOOKUP_STEP} days","mistake Max","mistake Ave","mistake Min"]

train_result=pd.DataFrame(columns=column_name)

r = tickerlistws.max_row

for i in range(1,r+1,1):

# get stock name

tickerEn =tickerlistws.cell(row=i, column=1).value

tickerpath=cpath+f"\\Stocks\\{tickerEn}"

# model name to save, making it as unique as possible based on parameters

model_name = f"{tickerEn}-{shuffle_str}-{scale_str}-{split_by_date_str}-epoch{EPOCHS}-dropout{DROPOUT}-{LOSS}-{OPTIMIZER}-{CELL.__name__}-layers-{N_LAYERS}-seq-{N_STEPS}-step-{LOOKUP_STEP}-units-{UNITS}"

#model_name = f"{date_now}_{tickerEn}-{shuffle_str}-{scale_str}-{split_by_date_str}-{LOSS}-{OPTIMIZER}-{CELL.__name__}-seq-{N_STEPS}-step-{LOOKUP_STEP}-layers-{N_LAYERS}-units-{UNITS}"

if BIDIRECTIONAL:

model_name += "-b"

# create these folders if they does not exist

if not os.path.isdir(tickerpath+"\\Train"):

os.mkdir(tickerpath+"\\Train")

if not os.path.isdir(tickerpath+"\\History"):

os.mkdir(tickerpath+"\\History")

ticker_data_filename = tickerpath + f"\\Train\\data-{tickerEn}-{shuffle_str}-{scale_str}-{split_by_date_str}-epoch{EPOCHS}-dropout{DROPOUT}-{LOSS}-{OPTIMIZER}-{CELL.__name__}-layers-{N_LAYERS}-seq-{N_STEPS}-step-{LOOKUP_STEP}-units-{UNITS}.csv"

test_data_filename= tickerpath + f"\\Train\\test-{tickerEn}-{shuffle_str}-{scale_str}-{split_by_date_str}-epoch{EPOCHS}-dropout{DROPOUT}-{LOSS}-{OPTIMIZER}-{CELL.__name__}-layers-{N_LAYERS}-seq-{N_STEPS}-step-{LOOKUP_STEP}-units-{UNITS}.csv"

result_filename = tickerpath + f"\\Train\\{model_name}.csv"

log_directory=tickerpath + f"\\Train\\{model_name}"

model_filename = tickerpath + f"\\{model_name}.h5"

ticker_tradeH_filename = tickerpath + "\\History\\Trade_H.csv"

ticker_clientH_filename = tickerpath + "\\History\\Client_H.csv"

# load the data

data = load_data(N_STEPS, scale=SCALE, split_by_date=SPLIT_BY_DATE,

shuffle=SHUFFLE, lookup_step=LOOKUP_STEP, test_size=TEST_SIZE,

feature_columns=FEATURE_COLUMNS)

# save the dataframe

data["df"].to_csv(ticker_data_filename)

# construct the model

model = create_model(N_STEPS, len(FEATURE_COLUMNS), loss=LOSS, units=UNITS, cell=CELL, n_layers=N_LAYERS,

dropout=DROPOUT, optimizer=OPTIMIZER, bidirectional=BIDIRECTIONAL)

# some tensorflow callbacks

checkpointer = ModelCheckpoint(model_filename, save_weights_only=False, save_best_only=True, verbose=1)

tensorboard = TensorBoard(log_dir=log_directory)

# train the model and save the weights whenever we see

# a new optimal model using ModelCheckpoint

history = model.fit(data["X_train"], data["Y_train"],

batch_size=BATCH_SIZE,

epochs=EPOCHS,

validation_data=(data["X_test"], data["Y_test"]),

callbacks=[checkpointer, tensorboard],

verbose=1)

# load optimal model weights from results folder

model.load_weights(model_filename)

# evaluate the model

loss, mae = model.evaluate(data["X_test"], data["Y_test"], verbose=0)

# calculate the mean absolute error (inverse scaling)

if SCALE:

mean_absolute_error = data["column_scaler"]["adjclose"].inverse_transform([[mae]])[0][0]

else:

mean_absolute_error = mae

# get the final dataframe for the testing set

test_data_predict = get_test_prediction(model, data)

# predict the future price

future_price = predict(model, data)

result=[loss,mean_absolute_error,future_price,test_data_predict["relative_mistake"].max(),test_data_predict["relative_mistake"].mean(),test_data_predict["relative_mistake"].min()]

train_result.loc[tickerEn]=result

# save the final dataframe to csv-results folder

test_data_predict.to_csv(result_filename)

train_result.to_csv(train_result_filename)